Activity-Based Cost Estimation Model for The Extrusion of Variant Aluminum Profiles

Volume 6, Issue 3, Page No 172-181, 2021

Author’s Name: Mohammad AL-Tahata), Issam Jalham, Abbas Al-Refaie, Mohammed Fawzi Alhaj Yousef

View Affiliations

Industrial engineering department, The University of Jordan, Amman, 11942, Jordan

a)Author to whom correspondence should be addressed. E-mail: altahat@ju.edu.jo

Adv. Sci. Technol. Eng. Syst. J. 6(3), 172-181 (2021); ![]() DOI: 10.25046/aj060320

DOI: 10.25046/aj060320

Keywords: Activity-based costing, Cost accounting, Activity cost drivers, Manufacturing cost, Extrusion economics, Extrusion process, Cost Estimation

Export Citations

A competitive manufacturing environment dictates to be conscious of the real cost of production to increase profitability, to have a precise cost estimation, and to avoid cost distortion. Activity-Based Costing (ABC) is one choice to achieve these objectives. This paper aims to build an ABC method, consequently, to explore its application for a local Aluminum extrusion factory that producing variant Aluminum profiles. The considered Aluminum extrusion factory is investigated carefully. Production resources, processes, and activities are identified for each product type, cost rates for each processing step are estimated, cost- estimating relationship model that mathematically describes the cost of the extruded product as a function of all consumable properties is created. Cost stream mapping through the production centers is analyzed then costs of existing resources are assigned, cost rates are obtained, accordingly results are discussed and presented. A comparison between the traditional costing method and the ABC is conducted, the comparison reveals that the ABC Estimates of the unit production costs are closer to reality than those obtained by the traditional costing method, contributing to the determination of realistic profit margins that are appropriate to the competitive market situation. Finally, recommendations and avenues for future works are suggested.

Received: 05 March 2021, Accepted: 03 May 2021, Published Online: 20 May 2021

1. Introduction

Improvement of system performance plays an important role in many areas of research. For example, the Kanban methodology as an improvement approach is presented in [1], performance improvement of maintenance effectiveness in health care services was investigated by [2]. On the other hand, business performance using structural equation modeling was examined in [3], a problem of multiple criteria decision making (MCDM) for a pharmaceutical system was solved in [4]. In other studies:

- Improvement of pharmaceutical tablet production was investigated in [5].

- A model to improve the constant work-in-process (CONWIP) using the continuous-time Markov chain modeling approach was presented in [6].

- The implementation of Concurrent Engineering (CE) methodology for performance improvements of some Jordanian industrial sectors was described in [7].

- An Activity-Based Cost Estimation Model for steel foundry to improve cost estimation was explained in [8].

This paper aims to develop an activity-based cost estimation model to be suitable for use in aluminum profile extrusion plants of various shapes and types. The proposed model is expected to contribute to an estimate of manufacturing costs closer to reality with more accuracy and precision.

The use of accurate and precise costing methods has become a major need in all fields of manufacturing as it enables managers to take appropriate planning and control decisions. Generally, two costing methods may follow in manufacturing [9], the first is the traditional Costing (TC) method that implies job ordering and process costing, and the second one is the Activity Based Costing (ABC) method, which was conceived in the mid-’80s by [10]. ABC method was mainly used to correct misleading overhead allocations. Furthermore, the method is elaborated to solve the distortion problems of the traditional costing system [10,11]. The Chartered Institute of Management Accountants [12] defines ABC as an “approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilize cost drivers to attach activity costs to outputs” [12]. ABC has aroused considerable interest in the last forty years, it produced precise cost estimates and designed to solve many obstacles and distortion costs [13], which cannot be solved by the traditional costing approach. Therefore, ABC is used with medium- and long-term planning horizon which is known as a strategic cost system [13]. Unlike the TCS method, ABC traces the overhead to an activity related to the product, rather than to the product itself [14]. The ABC method provides relevant and useful information for the decision-making process in various domains, such as the definition of cost and sales prices of products, the identification of processes where greater effort is needed to improve or adapt them to the new realities and needs, and the restructuring of some areas of the industrial unit [15]. A method for overcoming the limitations of TC was presented in [16]. ABC has received its name because of the focus on the activities performed in the realization of a product it has become a mature cost estimation and accounting method [13]. Recently, the main research on the ABC costing system had been highlighted in [17], the developments in growth and future research opportunities, and the mutual contribution on the topic between foundations, and authors over time had been also highlighted in [17]. In [18] the ABC method was applied on the inductor element for better precision in an electronic manufacture located at Pahang, Malaysia. Managers of manufacturing systems facing the challenges of estimating accurate costs and of setting a realistic profitable selling price of their products, specifically in a multi-products multi-process manufacturing system, where there is a high overlapping between production activities, and when the overhead costs are high. Setting a realistic profitable selling price that considers all costs elements also constitutes a challenge for most manufacturers. Referring to [19,20], the advantages of ABC can be summarized as; (1) Provides accurate cost estimate, (2) Flexible, (3) effective for long term planning, (4) Offers significant financial and non-financial measures at an operational level. (5) Supports better pricing policy. (6) Helps to understand the cost behavior of products, (6) helps management to highlights costing problems, (7) Highlight’s opportunities for improvements, and (8) assigning the overhead cost based on processes and activities.

These advantages have inspired the authors of this paper to investigate the methodology of employing ABC principles in one local Jordanian Aluminum extrusion factory. The selected extrusion factory produces variant Aluminum profiles that fit with the market’s demand. In particular, the objective of this work is to: (1) Develop ACB model that fits the selected Aluminum extrusion factory in Jordan, moreover, it can be implemented also for any aluminum extrusion factory. (2) Estimate the manufacturing costs of producing Aluminum profiles using the developed ABC method for the Aluminum profiles that can be produced by the considered factory. (3) Revealing the advantages of the ABC approach over the Traditional costing system (TCS) by comparing them.

After investigating the literature referred to in this paper, other recently published scientific papers that examined the application of ABC to material extrusion processes in general and aluminum extrusion specifically were searched. The authors found that there are scientific papers close to the field of this research, such as [21–23], at the same time the authors were unable to find published papers that deal with the current research scope. Consequently, this paper has contributed to a unique and qualitative scientific contribution, which is the application of ABC as a modern accounting method to a specific manufacturing process, which is the aluminum extrusion process, which enhances the novelty of this research, considering the continuous search of production managers and industrial cost analysts, to find the most accurate, and objective accounting methods, as is the case in the ABC method.

2. Modeling of Aluminum extrusion activities and resources consumption

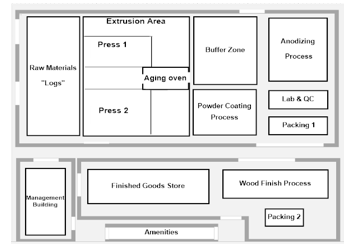

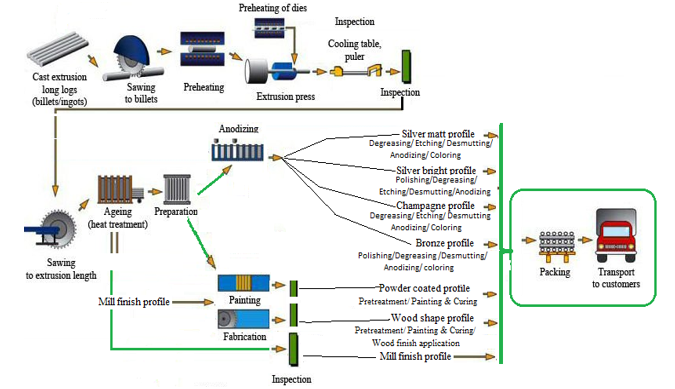

This paper is considering an aluminum extrusion factory that produces seven types of Aluminum profiles namely, (1) mill finish profile, (2) powder coated profile, (3) wood finish profile, (4) silver matt profile, (5) Bright silver profile, (6) champagne profile, and (7) bronze profile. These products are produced through the following main processes; (a) extrusion, (b) powder coating, and (c) anodizing. In the Anodizing process, silver matt profile, bright silver profile, champagne profile, and bronze profile are produced. As shown in Figure 1, the extrusion of aluminum is the transformation of raw aluminum logs into variant profiles shape, aluminum logs are fed to the manufacturing system and flow through the production line according to the layout shown by Figure 2. Details of the typical extrusion process of aluminum profiles are depicted in Figure 3. As shown in Figure 3, the mill finish profile was produced after the extrusion process, then packed and shipped directly after finishing the heat treatment process at the aging furnace without any surface treatment.

Figure 1: Extrusion manufacturing system of aluminum profiles

Figure 1: Extrusion manufacturing system of aluminum profiles

Figure 2: Layout of the proposed extrusion manufacturing system and its support departments

Figure 2: Layout of the proposed extrusion manufacturing system and its support departments

Figure 3: Details of the typical extrusion process of aluminum profiles

Figure 3: Details of the typical extrusion process of aluminum profiles

Mill finish profile may be transformed through the anodizing process into, silver matt profile, bright silver profile, champagne profile, or bronze profile upon request, the profile moves to a sequence of dipping stages of 18 baths. Mill finish profile may be transformed through the powder coating process to produce the powder-coated profile. Also, the mill finish profile may be transformed through the wood finish application process to produce the wood shape profile. Silver matt, silver bright, champagne matt, and bronze profiles are an anodized profile. Some Aluminum extrusion factories cost these four products as a unit one, although they have different processing sequences.

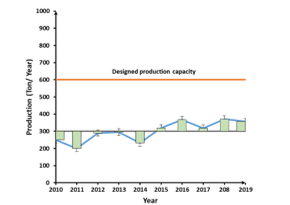

Extrusion Factor (EF) is the ratio of the average yearly production to the standard designed production capacity over a year. As in Figure 4, production of aluminum profile over the last ten years are investigated, yearly production is found to be 300 tons of different aluminum profiles, the average EF of a designed production capacity of a maximum of 600 tons is equal to (0.50).

Figure 4: Actual capacity of Extrusion Factor (EF) over the past ten years

Figure 4: Actual capacity of Extrusion Factor (EF) over the past ten years

To achieve the objective of our work an extrusion factor of 0.5 is considered. Under this scenario, cost rates are derived for every resource, accordingly, the total production cost can be estimated either by TC or ABC methods.

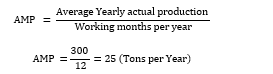

The monthly production is estimated by spreading the average of the actual yearly production over 12 working months, therefore the actual Monthly Production (AMP) production quantity is:

2.1. Activities and activity centers

2.1. Activities and activity centers

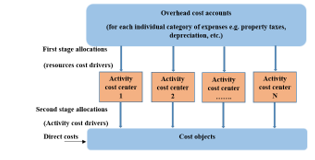

Cost allocation was defined in [20] as; “the process of assigning costs when a direct measure does not exist for the number of resources consumed by a particular cost object”. Cost allocations in ABC consist of two stages [8], in the first stage the overhead costs are assigned to cost centers, while in the second stage, cost rate are assigned to the jobs according to activities required to accomplish the extrusion process, this stage needs to have an accurate cost set that accounts for how much it costs to create a product. Figure 5 illustrates the two stages of allocation.

As shown in Figure 3, many activities being carried out in the system. The main activities are; acquisition long logs, sawing long logs into billets, billets preheating, preparation of extrusion press, extrusion, the extruded products then pass through cooling and inspection stages, then cut to the required length, heat-treated, products may move to preparation or fabrication. Anodized items may go through; degreasing, etching, smutting, coloring, or polishing, and painting. Fabricated items move to, pre-treatment, painting, curing, and wood finish application. Finally, any final product will be inspected, packed, and shipped to external customers. Such activity centers are traced, resources needed to accomplish each activity are identified, it is assumed that these activity centers consume certain levels of resources. The resource consumption is calculated using utilization levels of these centers per Kilogram of final extruded profiles.

Figure 5: Two-stage allocation process for an activity-based costing system

Figure 5: Two-stage allocation process for an activity-based costing system

2.2. Resources consumption

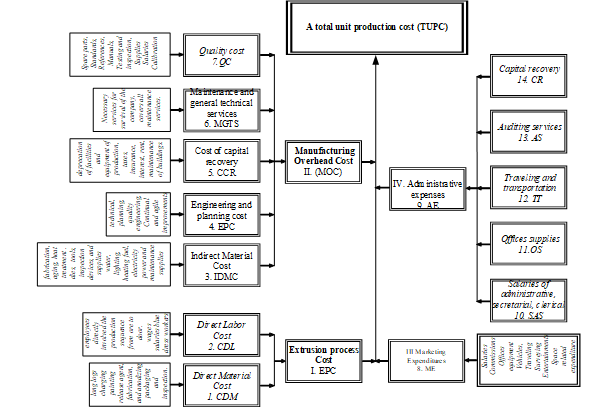

ABC estimation of a total unit production cost (TUPC) is calculated based on activity center costs that contribute to the production of the product. In this context, unit production cost (UPC) is the summation of the costs of activities that go on to produce that product. For every activity, one should calculate how much the cost of the consumed resources. Costs of activities that go on to produce certain aluminum profile can be classified – as shown in Figure 6- into the following four categories: 1) Cost of resources related to the extrusion process (EPC), 2) Cost of resources related to the Manufacturing Overhead Cost (MOC), 3) Cost of resources related to Selling and Marketing (SMC), and 4) cost of resources related to the Administrative Cost (ADC), these classes are explained briefly as follows;

- I) Cost of resources related to the extrusion process (EPC). Represents values expenditures of direct labor and direct materials, EPC involved:

Item 1. Cost of direct material (CDM): costs of materials directly charged to the extruded profile during its passage through the plant. This cost element considers long logs charging materials cost, painting materials, release agent, consumed materials for fabrication, consumed materials during the anodizing operations, and consumed materials in packaging and inspection.

Item 2. Cost of direct labor, (CDL). Cost of employees directly involved in the extrusion of the aluminum profiles. Such as wages and salaries paid for the involved blue dress workers.

- II) Cost of resources related to the Manufacturing Overhead Cost (MOC). MOC embraces all expenditures incurred in the production of the aluminum profiles that are not direct material or direct labor. MOC implies:

Item 3. Indirect material cost, (IDMC). Cost of materials that are not directly charged to the extrusion, such as; materials consumed in fabrication, aging, heat treatment, extrusion dies, tools, inspection devices, and supplies used include water, lighting, heating fuel, electric power, and maintenance supplies. Also, extrusion dies, consumed materials for cutting, painting, and heat treatment (heat treatment media, wooden materials, cutting off tools, etc.), lubricant, coolant, and painting materials. Engineering and planning cost, (EPC). Covers engineering department and technical, planning, quality engineering, Continual and agile improvements, maintenance, etc.

Figure 6: Main Components of the Developed ABC Structure

Figure 6: Main Components of the Developed ABC Structure

Item 5. Cost of capital recovery (CCR). Encompasses deprecation cost of facilities covering equipment and production facilities, taxes, insurance, interest, rent, maintenance of production buildings, and other related hidden costs.

Item 6. Maintenance and general technical services (MGTS), such as failure costs, prevention costs, surplus cost, and necessary maintenance services for the survival of the company.

Item 7. Quality cost (QC). The cost spent to buy spare parts, standards, references, manuals, testing and inspection, and other materials supplies needed for quality management activities. It also includes rework cost, significant costs related to quality, and salaries of operators and calibration costs.

III Marketing Expenditures (ME).

Item 8. ME includes salaries of sales and marketing personnel, commissions, cost of using office equipment and different vehicles, traveling cost, surveying cost, entertainment of customers, sales space, and other related expenditures.

- IV) Administrative expenses (AE), which implies the followings:

Item 9. AE is related to such items as; (10) salaries of administrative, secretarial, and clerical personnel; (11) office supplies; (12) traveling and transportation, (13) auditing services that are necessary to direct the operation, and other related issues.

Item 14. Capital Recovery (CR). Represents the depreciation on such equipment as vehicles, cars, machines, land, offices, hardware and software systems, and other facilities belonging to the company but not related directly to the production.

It is worthy to mention in this regard that costs elements, such as hidden costs, surplus costs, rework cost, failure costs, prevention costs and other significant costs are present in every work center and are considered when estimating the cost rates within work centers.

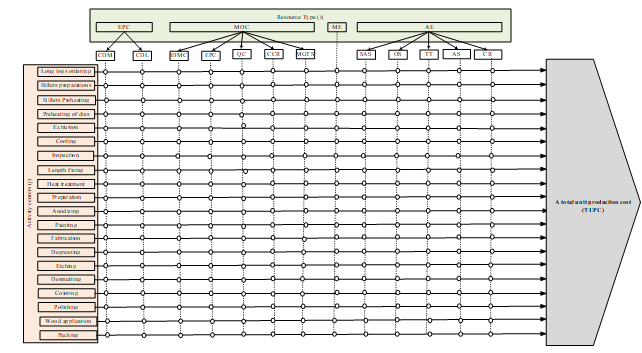

3. Mapping cost of resources with activity centers

Twenty different activities are identified to produce the aluminum profiles, Figure 7, these are; (1) Long logs ordering, (2) Billets preparations, (3) Billets Preheating, (4) Preheating of dies, (5) Extrusion, (6) Cooling, (7) Inspection, (8) Billet-length fixing, (9) Aging (Heat treatment), (10), preparation for the production of non-standard profiles, (11) Anodizing, (12) Painting, (13) Fabrication, (14) Degreasing, (15) Etching, (16) Desmutting, (17) Coloring, (18) Polishing, (19) Wood application, (20) Packing. Consequently, resources are allocated, then the summation of costs of resources that are consumed by every activity center is calculated. Based on the cost structure model presented in the previous sections. The determination of which activity consumed which resource and how much of the resource is used by that activity is the key to cost calculation. Figure 7 demonstrates the relationship between resources and activities and how these relations contribute to the final production cost, the figure shows that the cost of the produced Aluminum profiles is estimated based on how starting components and raw materials physically flow within the activity centers through the deferent division of the factory. The production unit production cost (TUPC) of the produced profiles reflect the cost of resources and Work-In-Process (WIP) items account at each activity center.

4. ABC costing of total production unit production cost

Notations presented in Table 1 are used for mathematical representation of the model. Figure 3 is a general illustration of the flow of any type of aluminum profile. For a specific profile type, some modifications may be required. Some profiles are not pass through all the activity centers and hence the allocated cost for the non-passed centers will be zero. For example, the mill finish profile is finally produced after heat treatment, Anodizing, Painting, Fabrication, Degreasing, Etching, Desmutting, Coloring are not visited by this product.

Figure 7: Contribution to final cost and relationship between resources and activity center

Figure 7: Contribution to final cost and relationship between resources and activity center

Table 1: Used Notations

| Symbol | Description |

| TUPC | Total unit production cost, $/1000 Kilogram |

| I | Total available number of resources |

| i | Resource index (i = 1, 2, . . . . I) |

| J | Total available number of activity centers |

| j | Center index (j = 1, 2, . . . . J) |

| Rij | Cost rate of consuming the ith resource at the jth activity center for producing a one-kilogram profile. ($/1Kg) |

4.1. ABC cost rates

4.1. ABC cost rates

The primal target of this paper is to present an ABC approach for estimation TPUC, this work will not consider the detailed derivation of how the rates (Rij) are drawn. These cost rates represent the values of resources consumed by work centers. The computation of these rates is highly dependent on the skills and on the experience of the industrial engineers who computed them. As a result, cost rates are presented in Appendix 1. These cost rates cover the whole range of the profiles. Reference to the activity resource relationships shown in Figure 7, TPUC for any Aluminum profile type can be calculated using equation (1). The total production cost of any finished Aluminum profile is the sum of the allocated costs at each activity center the part undergoes during its journey of the production process.

4.2. ABC calculations

According to Figure 7, TUPC is the sum of the allocated costs for each activity center the part undergoes in its production process. TUPC for any profile type can be computed by equation (1) using the cost information given in Table 2.

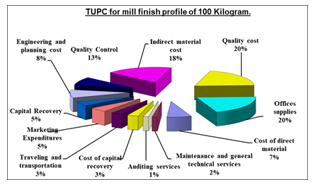

Figure 8: Cost-percentages allocation of mill finish profile.

Figure 8: Cost-percentages allocation of mill finish profile.

Consider a mill finish Aluminum profile of 100 Kilogram. TUPC of this item is the summation of cost for all consumed resources ($448). Cost-percentages allocation of the considered profile in terms of resource areas associated with its production processes is shown in Figure 8. Similarly, TPUC for all profiles are computed, then presented in Table 3.

4.3. Traditional costing system versus Activity-Based costing.

According to the Traditional Costing System (TCS) that is followed by the factory, the total costs of the considered profiles are shown in Table 4.

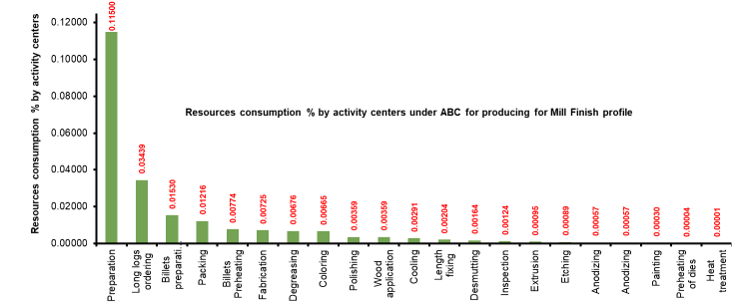

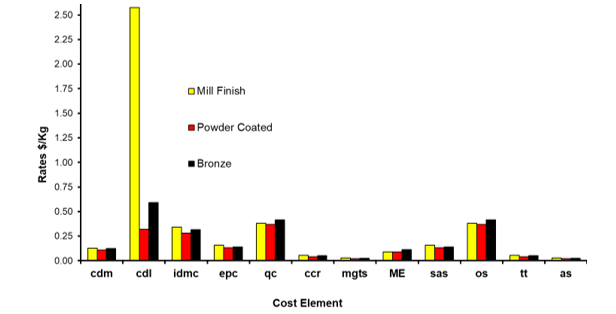

Based on ABC, the most expensive Aluminum profile is Mill Finish, while the lowest cost is for Powder Coated profile. Based on TCS, the most expensive profiles are Silver Bright, Champagne, and Bronze profile, while the lowest cost is for Mill Finish profile. ABC depicts the cost visibility that can be considered as a visual tool that shows how costs are contributed to total production unit production cost (TPUC) downstream the considered extrusion factory through the different production activities, Pareto chart in Figure 9 highlights how resources consumption contributes to TPUC through the different production activities for Mill Finish profile. ABC results can provide quantitative figures to how the costing process is appraised and the improved visibility of cost through the allocation of cost from resources to activities. ABC enables managers to recognize the hierarchy of all cost elements, not only the direct and indirect costs elements as in TCS. According to what had been presented in [23] a brief and purposeful, comparison between the benefits and the drawbacks of both the traditional and the ABC costing methods is presented in Table 5 where the critical characteristics of ABC versus TCS are examined. Figure 10 shows that the most important cost parameters are the cost of direct material (CDM), Cost of direct labor (CDL), Indirect material cost (IDMC), marketing expenditures (ME), salaries of administrative, secretarial, and clerical personnel (SAS) and cost of offices supplies. The final production cost is highly sensitive to such highlighted parameters. Verification of results is conducted by comparing results with those obtained by the traditional costing system TCS.

The methodology pursued in this work is valuable for Aluminum extrusion with more accuracy and precision when comparing with the TCS. That enables managers to estimate the cost of WIP at any time during the production sequence. ABC has some limitations, as the number of activities increases, the cost of estimation becomes higher., in addition to the difficulties of gathering activity data in service organizations and labor-intensive companies due to the variant and overlapped human activities.

5. Conclusions

The desired objectives of the research were successfully achieved, and the developed ABC model was suitable for use in estimating the costs of extruding aluminum profiles. Moreover, this costing model is used to compare the costs of extruding different profiles, which helps the management in ordering the consequent marketing and productivity priorities. It is concluded that the most expensive Aluminum profile is Mill finish, while the lowest cost is for Powder coated profile. ABC depicts the cost visibility that can be considered as a visual tool that shows how costs are contributed to total production unit production cost (TPUC). ABC enables managers to recognize the hierarchy of all cost elements, not only the direct and indirect costs elements as in TCS. The most important cost parameters are the cost of direct material (CDM), Cost of direct labor (CDL), Indirect material cost (IDMC), marketing expenditures (ME), salaries of administrative, secretarial, and clerical personnel (SAS), and cost of offices supplies.

Table 2: Computations of TUPC ($) for a mill finish Aluminium profile of 100 Kilogram weight.

| Resource Type (i) | Profile type | Activity Center (j) | Sub-Total | ||||||||||||||||||||

| J=1= Long logs ordering | J=2= Billet’s preparations | J=3 Billets Preheating | J= 4 Preheating of dies | J=5 Extrusion | J=6= Cooling | J=7= Inspection | J =8= Length fixing | J=9= Heat treatment | J= 10 = Preparation | J=11 Anodizing | J=12= Painting | J=13 = Fabrication | j = 14= Degreasing | j = 15 = Etching | j = 16 = Desmutting | j = 17 = Coloring | j = 18 = Polishing | j = 19 = Wood application | j = 20 = Packing | ||||

| CDM | Mill Finish | 0.025 | 0.023 | 0.016 | 0.000 | 0.001 | 0.004 | 0.000 | 0.002 | 0.000 | 0.016 | 0.000 | 0.000 | 0.004 | 0.021 | 0.000 | 0.009 | 0.004 | 0.000 | 0.000 | 0.000 | 0.13 | |

| CDL | 0.240 | 0.020 | 0.020 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 2.240 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.000 | 0.051 | 0.000 | 0.000 | 0.000 | 2.57 | ||

| IDMC | 0.077 | 0.087 | 0.087 | 0.000 | 0.008 | 0.015 | 0.003 | 0.000 | 0.000 | 0.000 | 0.008 | 0.003 | 0.001 | 0.045 | 0.000 | 0.001 | 0.007 | 0.000 | 0.000 | 0.000 | 0.34 | ||

| EPC | 0.060 | 0.006 | 0.005 | 0.000 | 0.001 | 0.003 | 0.000 | 0.000 | 0.000 | 0.013 | 0.000 | 0.000 | 0.000 | 0.027 | 0.009 | 0.012 | 0.001 | 0.007 | 0.007 | 0.007 | 0.16 | ||

| QC | 0.087 | 0.080 | 0.010 | 0.000 | 0.004 | 0.015 | 0.010 | 0.019 | 0.000 | 0.007 | 0.001 | 0.001 | 0.002 | 0.007 | 0.000 | 0.000 | 0.030 | 0.007 | 0.007 | 0.093 | 0.38 | ||

| CCR | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.057 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.06 | ||

| MGTS | 0.013 | 0.001 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.010 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.03 | ||

| ME | 0.014 | 0.001 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.005 | 0.021 | 0.021 | 0.021 | 0.09 | ||

| SAS | 0.060 | 0.006 | 0.005 | 0.000 | 0.001 | 0.003 | 0.000 | 0.000 | 0.000 | 0.013 | 0.000 | 0.000 | 0.000 | 0.027 | 0.009 | 0.012 | 0.001 | 0.007 | 0.007 | 0.007 | 0.16 | ||

| OS | 0.087 | 0.080 | 0.010 | 0.000 | 0.004 | 0.015 | 0.010 | 0.019 | 0.000 | 0.007 | 0.001 | 0.001 | 0.002 | 0.007 | 0.000 | 0.000 | 0.030 | 0.007 | 0.007 | 0.093 | 0.38 | ||

| TT | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.057 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.06 | ||

| AS | 0.013 | 0.001 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.010 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.03 | ||

| CR | 0.014 | 0.001 | 0.001 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.000 | 0.003 | 0.000 | 0.000 | 0.000 | 0.001 | 0.000 | 0.000 | 0.005 | 0.021 | 0.021 | 0.021 | 0.09 | ||

| TUPC of Mill Finish$/Kg | 4.48 | ||||||||||||||||||||||

| TUPC of Mill Finish of 100 Kg Weight ($/Kg) | 448.00 | ||||||||||||||||||||||

Table 3: TPUC of all Aluminum Profiles

| Profile Type | TPUC ($/Kg) |

| Mill Finish | 4.48 |

| Powder Coated | 2.03 |

| Wood Finish | 2.11 |

| Silver Matt | 2.04 |

| Silver Bright | 2.59 |

| Champagne | 2.95 |

| Bronze | 2.51 |

Table 4: Cost of all Aluminum Profiles based on traditional costing system

| Profile Type | Cost ($/Kg) |

| Mill Finish | 2.75 |

| Powder Coated | 3.18 |

| Wood Finish | 3.50 |

| Silver Matt | 3.89 |

| Silver Bright | 3.89 |

| Champagne | 3.89 |

| Bronze | 3.89 |

Table 5: Activity-Based Costing versus Traditional Costing

| Traditional Costing | Activity-Based Costing |

| – Simpler and easier

– Inexpensive. – Low overhead costs – With large production volume and low product’s Varity – For external cost reporting |

– Difficult to implement.

– Costly – High overhead costs – With low production volume and high product’s Varity – For internal cost reporting – Greater accuracy and precision. |

Figure 9: Resource consumption % by activity centers under ABC for Mill finish profile.

Figure 9: Resource consumption % by activity centers under ABC for Mill finish profile.

Figure 10: Comparison between Cost rate for every cost element for three profiles’ type

Figure 10: Comparison between Cost rate for every cost element for three profiles’ type

Conflict of Interest

The authors declare no conflict of interest.

Acknowledgments

We would like to express our sincere gratitude to the anonymous referee for his/her helpful comments that helped to improve the quality of this manuscript.

- M.D. Al-Tahat, “Optimizing of Work in Progress (WIP) in Kanban Controlled Production Lines,” Dirasat: Engineering Sciences, 32, 123–132, 2005.

- K.R. Al-Momani, M.D. Al-Tahat, E. Jarada, “Performance measures for improvement of maintenance effectiveness,” in Proceedings – ICSSSM’06: 2006 International Conference on Service Systems and Service Management, 632–637, 2006, doi:10.1109/ICSSSM.2006.320535.

- A.R. Abbas, M.D. Al-Tahat, “Effects of Knowledge Management and Organization Learning on Firms’ Performance,” The Journal of Nature Science and Sustainable Technology (JNSST), 8, 369–390, 2014.

- D. Dalalah, M.D. Al-Tahat, K. Bataineh, “Mutually Dependent Multi-criteria Decision Making,” Fuzzy Information and Engineering, 4(2), 195–216, 2012, doi:10.1007/s12543-012-0111-3.

- M.D. AL-Tahat, A.K.M. Abdul Jawwad, Y.L. Abu Nahleh, “Ordinal Logistic Regression Model of Failure Mode and Effects Analysis (FMEA) in Pharmaceutical Tabletting Tools,” Engineering Failure Analysis, 27(January), 322–332, 2013, doi:10.1016/j.engfailanal.2012.08.017.

- M.D. Al-Tahat, I.A. Rawabdeh, “Stochastic analysis and design of CONWIP controlled production systems,” Journal of Manufacturing Technology Management, 19(2), 253–273, 2008, doi:10.1108/17410380810847945.

- M.D. Al-Tahat, A.M. Al-Habashneh, I.S. Jalham, “A Statistical Comparison of the Implementation of Concurrent Engineering in Jordanian Industry,” Open Journal of Statistics, 09(03), 361–372, 2019, doi:10.4236/ojs.2019.93025.

- M.D. Al-Tahat, A.R. Abbas, “Activity-based cost estimation model for foundry systems producing steel castings,” Jordan Journal of Mechanical and Industrial Engineering, 6(1), 75–86, 2012.

- C. Drury, “Management and Cost Accounting Eighth Edition Colin Drury,” Management and Cost Accounting Eighth Edition Colin Drury, 7(2), 1–16, 2012.

- R. Cooper, R.S. Kaplan, “Measure Costs Right: Make the Right Decision.,” Harvard Business Review, 66(5), 96–103, 1988.

- R. Cooper, R.S. Kaplan, “How Cost Accounting Systematically Distorts Product Costs,” Accounting and Management Field Study Perspectives, 49–72, 1987.

- CIMA, Activity Based Costing Topic Gateway, 2008.

- C. Homburg, “Improving activity-based costing heuristics by higher-level cost drivers,” European Journal of Operational Research, 157(2), 332–343, 2004, doi:10.1016/S0377-2217(03)00220-0.

- L. Ronald, “Activity-based models for cost management systems,” Choice Reviews Online, 33(05), 33-2831-33–2831, 1996, doi:10.5860/choice.33-2831.

- L. Barreto, A. Amaral, T. Pereira, “The implementation of an Activity-Based Costing (ABC) system in a manufacturing company,” Procedia Manufacturing, 13, 1245–1252, 2017.

- I. Mahal, M. Akram Hossain, “Activity-Based Costing (ABC)-An Effective Tool for Better Management,” Research Journal of Finance and Accounting Www.Iiste.Org ISSN, 6(4), 66–74, 2015.

- P. Quesado, R. Silva, “Activity-based costing (ABC) and its implication for open innovation,” Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 1–20, 2021, doi:10.3390/joitmc7010041.

- N.F. Zamrud, M.Y. Abu, “Comparative Study: Activity Based Costing and Time Driven Activity Based Costing in Electronic Industry,” Journal of Modern Manufacturing Systems and Technology, 4(1), 68–81, 2020, doi:10.15282/jmmst.v4i1.3840.

- R. Sreekantha, Cost Management 6th Sem Bcom Product Speci cations, 2021.

- W.N. Lanen, S.W. Anderson, M.W. Maher, D.T. Dearman, “Fundamentals of Cost Accounting,” Issues in Accounting Education, 25(4), 791–792, 2010, doi:10.2308/iace.2010.25.4.791.

- A. Kampker, P. Ayvaz, G. Lukas, S. Hohenstein, V. Kromer, “Activity-based Cost Model for Material Extrusion Processes Along the Additive Manufacturing Process Chain,” in IEEE International Conference on Industrial Engineering and Engineering Management, 489–495, 2019, doi:10.1109/IEEM44572.2019.8978507.

- H. Gholami, N.S. Jiran, S. Mahmood, M.Z.M. Saman, N.M. Yusof, V. Draskovic, R. Jovovic, “Application of activity-based costing in estimating the costs of manufacturing process,” Transformations in Business and Economics, 18(2), 839–860, 2019.

- S. Bazrafshan, B. Karamshahi, “Examining the Disadvantages of Activity Based Costing (ABC) System and Introducing the Modern (Behavior Based Costing) (BBC) System,” International Journal of Management, Accounting and Economics, 4(2), 163–177, 2017.